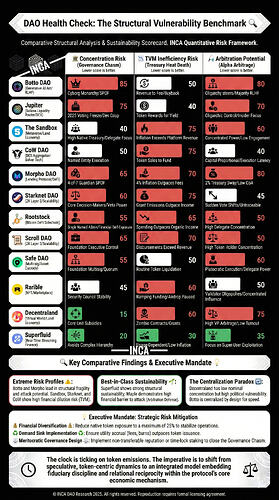

The Safe brief outlines the current dynamics of the DAO’s governance and tokenomics, framing its viability on a transition from token-centric speculation to disciplined operational interdependence of capital, governance, and community.

The summary is presented by INCA to inform community members and stakeholders about the protocol’s structural alignment.

Governance: Agency Aligned with Capital Weight

Safe DAO operates at the crossroads of decentralized ideals and institutional fiduciary discipline, where governance agency directly maps to capital ownership, creating an oligarchic quorum controlled by a delegates minority. This concentration reveals a core tension between distributed meritocracy and the plutocratic execution embedded in the pure one-token-one-vote system.

The governance framework retains a centralized execution node via the Safe Ecosystem Foundation’s multisig authority, responsible for operational decisions with mandatory couple-day delays on proposals before onchain enactment, balancing control with measured security akin to broader DAO ecosystem.

On the meritocratic front, the DAO is moving to address the gap between capital and contribution. The protocol is planning to use non-transferable digital badges and a reputation system to recognize and reward sustained, non-monetary labor over mere financial holding. This shift is vital for embedding relational sustainability, which prioritizes proven outcomes over speculative influence.

Legal Status and Security

The hybrid legal and functional setup leverages Swiss Foundation status to modularize regulatory risks by offloading select offchain operational responsibilities while underpinning legal protections for community members to mere non-security disclaimers.

The smart contract code is periodically reviewed by an external firm, and an active bounty program with significant rewards to support the discovery of code vulnerabilities. Nonetheless, continuous asset vulnerability challenges persist amid the operational expansion within the multichain and the centralized legacy upgrade mechanisms requiring diligent oversight.

Tokenomics: Revenue Dynamics and Treasury Stability

Tokenomics reveals structural selling pressures exacerbated by treasury operations like routine token liquidation to fund operations and external grants, often exceeding fee revenue. Additionally, controlled inflation through scheduled token vesting and engagement rewards sustains ecosystem growth while relaying on demand sinks like protocol service fees and token deposits for governance participation to justify utility and token holding commitment.

The DAO does not prioritize a structured system to reward community members for referring new users or sub-affiliates to the ecosystem.

Moreover, treasury concentration in native tokens and strategic crypto assets introduces volatility risk, partially mitigated by high financial barriers to hostile governance takeovers.

Interestingly, the DAO has officially set aside a specific pool of funds within its treasury to support projects deemed beneficial for the broader public good, establishing institutional accountability frameworks.

Financial infrastructure as public good

DAO’s governance and tokenomics behave not as static constructs but a coevolving relational processes embedded within community incentives.

The protocol sustainability transcends mere token-based metrics, highlighting a relational, fiduciary-focused perspective where distributed stewardship and economic rewards foster transparency, equity, and resilience within a dynamic ecosystem.