Summary

The June 2025 Endowment Report is now available on kpk’s website.

kpk is pleased to present its Community Update for the month of June to the broader Safe Community, to increase awareness and transparency of its activities.

Market Update

The market remained to be rangebound in June after an impressive rally in May. BTC (+2.54%) recorded out a small gain in June, successfully defending the psychologically important $100K level and stepping closer to the all-time high of $112k. ETH underperformed (-1.40%), the month between $2,400-$2,500. Institutional inflows continued, albeit at a pace lower than in May, and ETH ETPs saw their highest inflows for the year in June at around $1.1B. Bitcoin dominance remained largely flat (62.94% to 62.34%); some altcoins outperformed (SEI +45%, HYPE +20%, UNI +18%, AAVE +11%, BCH +22%), especially the DeFi-related tokens. This followed comments from the SEC Chair, Paul Atkins, who hinted at possible regulatory exemptions for US-based DeFi firms to operate with fewer constraints. Other altcoins underperformed BTC (XRP +3%, BNB -0%, SOL -1%).

Funding rates (both on-chain and off-chain) and open interest remained subdued, potentially reflecting higher levels of sidelined capital and/or retail and long-term holders selling. Several notable developments in the crypto space in June were:

- Non-Bitcoin Digital Asset Treasuries are gaining traction. In June, ETH and HYPE Digital Asset Treasury Companies were announced.

- ETH: After SharpLink (SBET) announced a $425M private placement to initiate a first-of-its-kind Ethereum treasury strategy, other companies like Tom Lee’s BitMine (BMNR) and Bit Digital (BTBT) are shifting from mining and holding Bitcoin to becoming pure-play Ethereum treasury and staking companies.

- HYPE: Eynovia (EYEN), a Nasdaq-listed company, announced it had raised $50M to purchase HYPE tokens. The company plans to rename itself Hyperion DEFI and change its ticker to “HYPD”. Nasdaq-listed Lion Holdings Group (LGHL) also disclosed that it had secured $600M to establish its crypto treasury. The primary reserve asset will be the HYPE token. They also stated that they are looking to add SOL and SUI to their balance sheet.

- Robinhood ($HOOD) revealed its long-awaited blockchain product suite, including tokenised stocks trading and crypto perpetual futures. The tokenised stock trading is especially interesting, as it would offer 24/5 access to tokenised stock trading to European investors. The stock tokens will initially be issued on Arbitrum. Robinhood is also building their proprietary Layer 2 blockchain, based on the Arbitrum tech stack. This is in line with the “be a landlord not a tenant” crypto strategy laid out by Vlad Tenev, the company’s CEO. This also comes closely after Robinhood completed its $200M acquisition of Bitstamp on June 2, 2025.

- The Genius Act passed the US Senate with strong bipartisan support. The long-awaited bill establishes a federal framework for regulating payment stablecoins in the US, thus providing regulatory clarity while enhancing consumer protection and safeguarding national security.

As we discussed last month, crypto treasury companies have been rewarded for buying digital assets and have outperformed the broader market in the medium term. This has created a virtuous cycle, attracting more participants and pushing some of them further along the risk curve.

However, We remain concerned that if this trend reverses and the market stops allocating surplus value to corporations following this strategy, corporate demand for crypto could dry up. In such circumstances, the premium to net asset value (NAV) of these crypto treasury companies would likely compress, as seen for Grayscale’s premium last cycle. We believe this dynamic remains an important market signal and are monitoring it closely as part of our broader treasury outlook.

Figure 1: Return statistics of major assets

SAFE Token Update

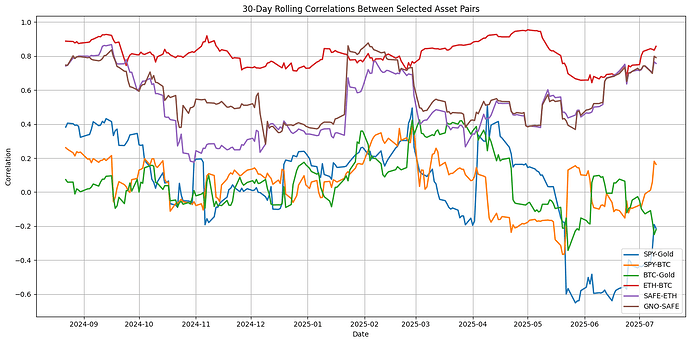

$SAFE (-23%) underperformed BTC and ETH in June. $SAFE correlation to other crypto was relatively higher (0.8-0.9) vs. last month. The current circulating supply of the $SAFE token stands at ~607M SAFE token (60% of total supply), with monthly unlocked supply expansion of ~2% based on initial tokenomics.

Figure 2: 30-day Correlation

Figure 3: 30-day rolling Correlation

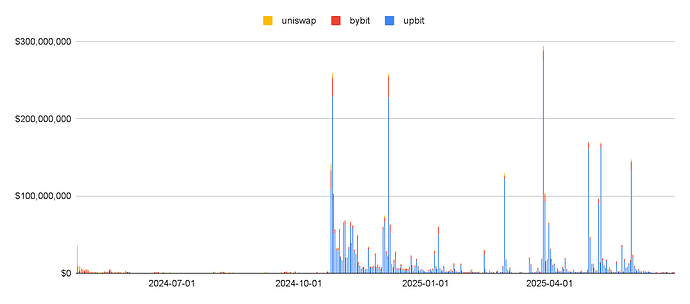

$SAFE continues to enjoy elevated off-chain trading volume, especially on Korean exchanges, such as Upbit. Upbit is also likely the largest, non-ecosystem holder (i.e. not SafeDAO or Foundation-related wallets) of $SAFE tokens.

Below is a distribution of daily trading volume on 3 major venues (Upbit, Bybit, Uniswap v3 0.3% pool).

Figure 4: SAFE volume distribution (Uniswap v3 0.3%, Bybit, Upbit)

Figure 5: SAFE volume (Uniswap v3 0.3%, Bybit, Upbit)

JT Update

Financial Update

Asset Allocation

- Joint Treasury’s AUM stood at $22.7M at the end of June, with 85.5% in $SAFE, 7.5% in ETH, and 5.8% in stablecoins.

- Asset utilisation remains low at 19.5%, as most of the Joint Treasury remains concentrated in $SAFE token with limited onchain usage. 99.8% of non-SAFE assets are being utilised to either generate yield and/or to support on-chain $SAFE liquidity.

- Usage of Joint Treasury assets can be divided into three broad categories:

- SAFE Usage (48M SAFE): 5% of $SAFE is currently being used for providing on-chain $SAFE liquidity on Uniswap V3 Ethereum Mainnet; the majority (95%) is being held idle in the wallet

- ETH Usage (681 ETH): 82% of ETH is currently being used to earn yield on Liquid Staking Protocols (Lido, Stakewise), and the remaining 18% (125.77) is used to provide on-chain $SAFE liquidity on Uniswap V3 Ethereum Mainnet.

- Stablecoin Usage (1.3M wxDAI): all stablecoins are currently held in sDAI on Gnosis Chain, earning the DAI Savings Rate (5.2%).

$SAFE On-chain Liquidity Management

- The main avenue for on-chain $SAFE liquidity management is Uniswap V3 on Ethereum Mainnet, using multiple ranges to ensure sufficient liquidity through market volatility.

- $SAFE liquidity has improved, and $10k swaps can be conducted with relatively low levels of slippage:

- $10k Purchase (ETH → SAFE) can be conducted with 129bp price impact on Uniswap V3; on CoW, the impact is quite low (<50bp)

- $10k Sale (SAFE → ETH) can be conducted with a 57bp price impact on Uniswap V3; on CoW, the impact is greater at 158bp.

- On-chain liquidity management of SAFE/WETH pools has supported the token liquidity depth and had the following financial impact:

- Total PnL from Uniswap V3 positions was -$10.9k ($5.4k from fees generated vs. -$16.3k from divergence loss).

- Comparable tokens for benchmark include: GRT, LINK, LDO, ETHFI, W, EIGEN, GNO. These tokens share some similarities with SAFE

- Similar market capitalisation, i.e. in Top 100-200 (LDO, ETHFI, W, EIGEN, GNO).

- Token generation/transferability events took place in 2024 (ETHFI, W, EIGEN).

- Widely considered as top DeFi infrastructure projects.

Other Updates

- SafeBoost Programme has been running, after resuming on May 20, 2025 (original proposal):

- SafeBoost is an ecosystem initiative by the Joint Treasury aimed at boosting Safe usage on Gnosis Chain. 250,000 $SAFE has been allocated to the Programme, and will be distributed to users who participate in the Programme.

- We will be introducing ‘Epochs’, each focusing on a specific partner. This will allow us to give the partners greater marketing exposure and educate the community on Gnosis Chain and Safe ecosystems.

- Investment Policy Statement (IPS) for the JT is currently being reviewed by key JT stakeholders and will be shared with the community shortly for their review. For more information about IPSs, see our article.