Summary

The July 2025 Endowment Report is now available on kpk’s website.

kpk is pleased to present its Community Update for the month of July to the broader Safe Community, to increase awareness and transparency of its activities.

Market Update

-

The crypto market continued its uptrend in July, marking the 4th consecutive month of positive returns.

-

BTC finished the month up +9%, reaching a new all-time high above $123k before settling in the $118–$120k range by month-end. ETH stole the limelight, surging +52%; it briefly exceeded $4,000 before closing in the $3,780–$3,800 range. Institutional inflows increased and reached close to $11.2B, with Ethereum-based products drawing almost $5B for the month, while Bitcoin products saw total inflows of around $5.5B.

-

Bitcoin dominance declined slightly (62.34% to 60.87%) as ETH outperformed all other majors; some altcoins did incredibly well (ZORA +702%, SPK +290%, ENA +138%, PENGU +127%). Ethena was specifically interesting as the rally was accompanied by an increase in USDe supply ($5.3b to $8.6b) as well as news of Digital Asset Treasury company for ENA. Other Top 20 altcoins also ended the month positive, but underperformed ETH (XRP +45%, SOL +35%, BNB +17%, HYPE +3%).

-

The total implied network value (market cap) of the digital asset market stood at $3.85tn at the end of July, up 12.2% for the month (from $3.43tn).

-

-

Crypto funding rates fluctuated significantly during July without reaching extreme levels:

-

Off-chain Funding Rates: Both BTC and ETH funding rates stayed between 3% to 11% on Binance despite the positive price action. Open Interest for Binance BTC and ETH perps saw an increase (BTC Perps: 110k to 130k, ETH Perps: 2.35M to 2.56M)

-

On-chain Funding Rates: On Hyperliquid, the rate fluctuations were much more pronounced; ETH funding moved between 6% and 64%, while BTC funding was between 6% and 47%. Open interest for ETH exploded from $1.35B to $4B, partly due to the huge price increase, but still significant. BTC open interest grew from $3B to $4.5B.

-

Several notable developments in the crypto space in July were:

-

Digital Asset Treasuries continued gaining traction, and drove the demand for ETH.

-

Tom Lee’s BitMine Immersion Tech (BMNR), which is targeting to hold 5% of total ETH supply, bought 300K ETH in July, and finished the month with a total of 566K ETH in their treasury.

-

Sharplink (SBET) also continued to stack their ETH treasury, growing from 198K to 361K ETH.

-

Other companies like The Ether Machine (DYNX) and Bit Digital (BTBT) also followed suit.

-

-

SEC Chair Paul Atkins unveiled “Project Crypto”, a commission-wide push to modernise securities rules and move U.S. financial markets on-chain. The plan replaces subjective Howey tests with clear, rule-based token classification. It creates tiered disclosure requirements based on market cap and trading volume. Safe-harbor provisions for tokenised securities and DeFi activities are also included. The draft rules are expected to come in Q4 2025, with potential final adoption by mid-2026. After years of regulatory uncertainty, crypto has a clear path forward.

As noted in previous updates, crypto treasury companies have been rewarded for buying digital assets, outperforming the broader market in the medium term. This has created a virtuous cycle, attracting more participants and driving some further along the risk curve.

However, we remain concerned that if this trend reverses and the market stops allocating surplus value to corporations following this strategy, corporate demand for crypto could dry up. In such circumstances, the premium to net asset value (NAV) of these crypto treasury companies would likely compress*,* as seen for Grayscale’s premium last cycle. This dynamic remains an important market signal, and we are monitoring it closely as part of our treasury outlook.

Figure 1: Return statistics of major assets

SAFE Token Update

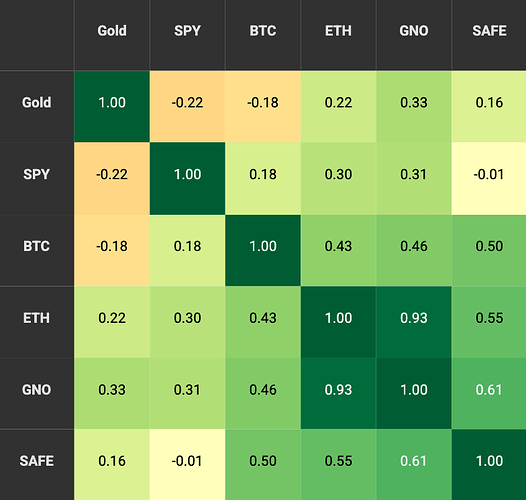

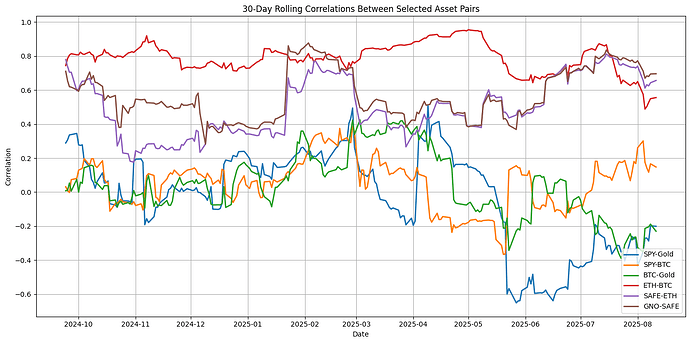

$SAFE (+9.5%) underperformed ETH, but outperformed BTC. $SAFE correlation to other crypto was lower than last month (0.5-0.6). The current circulating supply of the $SAFE token stands at ~620M $SAFE (62% of total supply), with monthly unlocked supply expansion of ~2% based on initial tokenomics.

Figure 2: 30-day Correlation

Figure 3: 30-day rolling Correlation

$SAFE continues to see elevated off-chain trading volume, especially on Korean exchanges, such as Upbit. Upbit is also likely the largest, non-ecosystem holder of $SAFE.

Below is a distribution of daily trading volume on 3 major venues (Upbit, Bybit, Uniswap v3 0.3% pool).

Figure 4: SAFE volume distribution (Uniswap v3 0.3%, Bybit, Upbit)

Figure 5: SAFE volume (Uniswap v3 0.3%, Bybit, Upbit)

JT Update

Financial Update

Asset Allocation

-

Joint Treasury’s AUM stood at $24.8M at the end of July, with 84.1% in $SAFE, 9.3% in ETH, and 5.3% in stablecoins.

-

Asset utilisation remains low at 21.5%, as most of the Joint Treasury remains concentrated in $SAFE with limited onchain usage. Nearly all non-$SAFE assets (99.7%) are being deployed to either generate yield or support $SAFE liquidity.

-

Usage of Joint Treasury assets can be divided into three broad categories:

-

$SAFE Usage (48M): 5.8% of $SAFE is currently being used for providing on-chain $SAFE liquidity on Uniswap V3 Ethereum Mainnet; the majority (94.2%) is being held idle in the wallet

-

ETH Usage (624): 89% of ETH is currently being used to earn yield on Liquid Staking Protocols (Lido, Stakewise), and the remaining 11% (71.5 ETH) is used to provide on-chain $SAFE liquidity on Uniswap V3 Ethereum Mainnet.

-

Stablecoin Usage (1.3M wxDAI): all stablecoins are currently held in sDAI on Gnosis Chain, earning the DAI Savings Rate (5.7%).

-

$SAFE On-chain Liquidity Management

-

The main avenue for on-chain $SAFE liquidity management is Uniswap V3 on Ethereum Mainnet, using multiple ranges to ensure sufficient liquidity through market volatility.

-

$SAFE liquidity remains healthy on mainnet, and $10k swaps can be conducted with following levels of slippage:

-

$10k Purchase (ETH → SAFE) can be conducted with 170bp price impact on Uniswap V3; on CoW, the impact is quite low (<30bp)

-

$10k Sale (SAFE → ETH) can be conducted with a 120bp price impact on Uniswap V3; on CoW, the impact is less than 100bp.

-

-

On-chain liquidity management of SAFE/WETH pools has supported the token liquidity depth and had the following financial impact:

- Total PnL from Uniswap V3 positions was -$18.2k ($20.2k from fees generated vs. -$38.4k from divergence loss).

Other Updates

- SafeBoost Programme has been running, after resuming on May 20, 2025 (original proposal):

-

SafeBoost is an ecosystem initiative by the Joint Treasury aimed at boosting Safe usage on Gnosis Chain. 250,000 $SAFE has been allocated to the Programme, and will be distributed to users who participate in it.

-

Starting in the first week of September, a 3x multiplier will be applied to all ecosystem partners until the end of the Programme. This adjustment is designed to provide partners with greater visibility and to boost DeFi usage through the Safe wallet. Bonus points will continue to be distributed to eligible participants engaging with these protocols.

- kpk Permissions has been implemented for Joint Treasury on both the Gnosis Chain and the Ethereum mainnet. kpk Permissions builds on the well-established Zodiac Roles Modifier (ZRM), and allows onchain entities to create roles with granular permissions. List of permissions granted to the Manager Safe (kpk-signers) can be seen here (for Mainnet) and here (Gnosis Chain).