The August 2025 Joint Treasury Report is now available on kpk’s website.

kpk is pleased to present its Community Update for the month of August to the broader Safe Community, to increase awareness and transparency of its activities.

Market Update

The digital asset market closed August on a strong note, with both BTC and ETH reaching new all-time highs (ATHs).

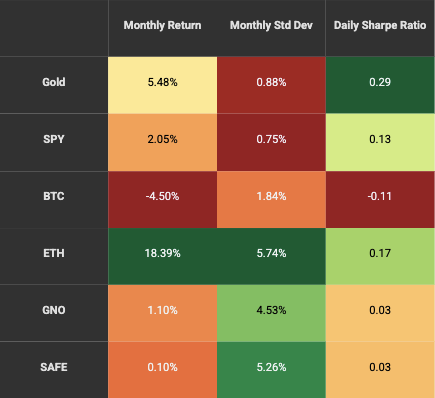

- BTC (-4.5% for the month) reached a new ATH of $124.12k mid-August, before retracing to close the month at $108.41k. ETH (+18.4% for the month) outperformed the broader market, peaking past $4.95k before closing the month at $4.38k.

- Institutional inflows slowed down to $4.37B, driven by growing adoption of ETH-based products ($3.96B), but partially offset by outflow from BTC-products (~$301M).

- Bitcoin dominance declined further (from 61% to 58%), driven by strong ETH outperformance. Some exchange-related tokens also made strong gains (OKB +262%, CRO +113%, MNT +67%, KCS +38%). OKB was up sharply after OKX announced the token supply will be cut in half. CRO was up on news of a new digital asset treasury company that will hold CRO, established in partnership with the Trump family. Other strong performers were LINK +48%, POL +43%, PUMP +36% and ARB +36%.

- The rest of the Top 20 digital assets by market cap showed mixed returns, with most underperforming ETH (XRP -5%, SOL +23%, BNB +13%, HYPE +3%).

- The worst performers for the month were BONK -17%, PENGU -16% and surprisingly SKY -16% as it failed to capitalize on the wider stablecoin narrative in August.

- The total implied network value (market cap) of the digital asset market stood at $3.84tn at the end of August and was largely flat for the month.

- Crypto funding rates fluctuated significantly during August without reaching extreme levels:

- Off-chain Funding Rates: Both BTC and ETH funding rates stayed between 5% to 12% on Binance despite choppy price action. Open interest for Binance BTC and ETH was almost flat (BTC Perps: 130k to 131k (BTC), ETH Perps: 2.56M to 2.64M (ETH))

- On-chain Funding Rates: On Hyperliquid, the rate fluctuations were much more pronounced; ETH funding moved between -6% and 38%, while BTC funding was between 5% and 38%. Interestingly, open interest for ETH and BTC was almost equal at $3.70B towards the end of the month.

Several notable developments in the crypto space during August were:

- Digital asset treasuries continued gaining traction, driving ETH demand.

- Tom Lee’s BitMine Immersion Tech (BMNR), which is targeting to hold 5% of total ETH supply, bought almost 1.30M ETH in August, and finished the month with a total of 1.80M ETH in their treasury.

- Sharplink (SBET) also continued to stack their ETH treasury, growing from 361K to 798K ETH.

- Other companies like The Ether Machine (DYNX) and ETHZilla Corporation (ETHZ) also followed suit. The total ETH held by public companies is now a staggering amount of 3.5M ETH or about 3% of the total token supply.

- In a landmark shift, the Commodities Futures Trading Commission announced that spot crypto asset contracts can now be traded on futures exchanges under its jurisdiction—ushering in enhanced federal-level clarity and collaboration with the SEC under “Project Crypto.”

- BlackRock crossed $100 billion in crypto holdings. As of August 14, BlackRock has accumulated approximately $104.00B in crypto assets, with Bitcoin comprising the lion’s share—underscoring a massive institutional commitment to digital assets.

- Crypto enters U.S. retirement plans as a Trump administration executive order now permits 401(k) and other retirement plans to invest in cryptocurrency investment vehicles, private equity as well as other alternative investments, potentially opening trillions in new capital flows while raising concerns about risk for ordinary savers.

As we pointed out in last month’s report, many digital asset treasury companies are now trading below a multiple of net asset value (mNAV) of 1, meaning the market values these companies below their net asset value. This suggests that the frenzy of DAT may begin to slowly fizzle out, potentially leading to the drying up of corporate demand for crypto. This dynamic remains a vital market signal, and we are monitoring it closely as part of our treasury outlook.

Figure 1: Return statistics of major assets

SAFE Token Update

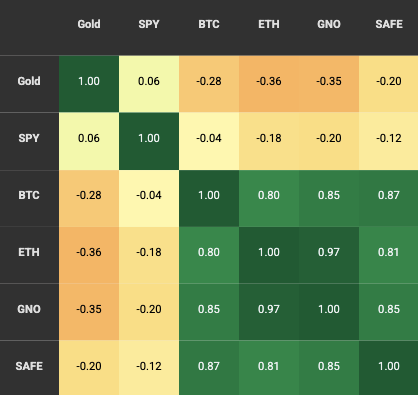

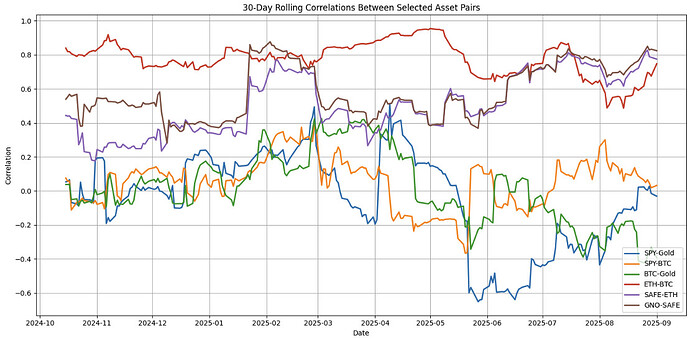

$SAFE (+0.1%) underperformed ETH again. $SAFE correlation to other crypto was higher than last month (0.8-0.9). The current circulating supply of the $SAFE token stands at ~634M $SAFE (64% of total supply), with monthly unlocked supply expansion of ~2% based on initial tokenomics.

Figure 2: 30-day Correlation

Figure 3: 30-day rolling Correlation

$SAFE continues to see elevated off-chain trading volume, especially on Korean exchanges, such as Upbit. Upbit is also likely the largest, non-ecosystem holder of $SAFE.

Below is a distribution of daily trading volume on 3 major venues (Upbit, Bybit, Uniswap v3 0.3% pool).

Figure 4: SAFE volume distribution (Uniswap v3 0.3%, Bybit, Upbit)

Figure 5: SAFE volume (Uniswap v3 0.3%, Bybit, Upbit)

JT Update

Financial Update

Asset Allocation

- Joint Treasury’s AUM stood at $25.3M at the end of August, with 83.0% in $SAFE, 10.6% in ETH, and 5.2% in stablecoins.

- Asset utilisation remains low at 23.6%, as most of the Joint Treasury remains concentrated in $SAFE with limited onchain usage. Virtually all non-$SAFE assets are deployed to generate yield or support $SAFE liquidity.

- Usage of Joint Treasury assets can be divided into three broad categories:

- SAFE Usage (49M SAFE): 8.0% of $SAFE is currently being used for providing on-chain $SAFE liquidity on Uniswap V3 Ethereum Mainnet; we’re currently exploring asset transformation strategies (using SAFE as collateral to borrow stablecoins / ETH), which requires on-chain lending market creation

- ETH Usage (608): 91% of ETH is currently being used to earn yield on Liquid Staking Protocols (Lido, Stakewise), and the remaining 9% is used to provide on-chain $SAFE liquidity on Uniswap V3 Ethereum Mainnet.

- Stablecoin Usage (1.3M wxDAI): all stablecoins are currently held in sDAI on Gnosis Chain, earning the DAI Savings Rate (5.7%).

$SAFE On-chain Liquidity Management

- The main avenue for on-chain $SAFE liquidity management is Uniswap V3 on Ethereum Mainnet, using multiple ranges to ensure sufficient liquidity through market volatility.

- $SAFE liquidity remains healthy on mainnet, and $10k swaps can be conducted with following levels of slippage:

- $10k Purchase (ETH → SAFE) can be conducted with 120bp price impact on Uniswap V3; on CoW, the slippage is 55bp.

- $10k Sale (SAFE → ETH) can be conducted with a 9bp price impact on Uniswap V3; on CoW, the impact is 135bp.

- On-chain liquidity management of SAFE/WETH pools has supported the token liquidity depth, and the JT will be further rebalancing to deepen SAFE liquidity in September.

Other Updates

- SafeBoost Programme has been running, after resuming on May 20, 2025 (original proposal):

- Starting in the first week of September, a 3x multiplier will be applied to all ecosystem partners until the end of the Programme. This adjustment is designed to provide partners with greater visibility and to boost DeFi usage through the Safe wallet. Bonus points will continue to be distributed to eligible participants engaging with these protocols.